sacramento county tax rate

The total sales tax rate in any given location can be broken down into state county city and special district rates. Calculate the taxable units.

Cost Or Renting Vs Buying Rent Vs Buy Best Mortgage Lenders Mortgage Payoff

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900.

. T he tax rate is 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer. Compilation of Tax Rates by Code Area. The California sales tax rate is currently.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County.

Learn more About Us. Sacramento county tax rate area reference by primary tax rate area. 1788 rows California Department of Tax and Fee Administration Cities Counties and Tax Rates.

Sacramento County Transfer Tax. The minimum combined 2022 sales tax rate for Sacramento California is. The current total local sales tax rate in Sacramento County CA is 7750.

Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US. Multiply the taxable units by the transfer tax. Sacramento Property Tax Rates.

To calculate the amount of transfer tax you owe simply use the following formula. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value. California City County Sales Use Tax Rates effective April 1 2022.

County of Sacramento Tax Collection and Business Licensing Division. After searching and selecting a parcel number click on the Supplemental Tax Estimator tab to see an estimate of your supplemental tax. By clicking Accept you agree to the terms of the.

Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 24 05 galt city of 26 06 citrus heights city of 29. What is the sales tax rate in Sacramento County. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by. Whether you are already a resident or just considering moving to Sacramento County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

For tax rates in other cities see. The December 2020 total local sales tax rate was also 7750. Our Mission - We provide equitable timely and accurate property tax assessments and information.

The Sacramento County Sales Tax is collected by the merchant on all. The latest sales tax rate for Sacramento CA. The statewide tax rate is 725.

This rate includes any state county city and local sales taxes. Some areas may have more than one district tax in effect. Monday Friday from 900am to 400pm.

This is the total of state and county sales tax rates. A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700.

What is the sales tax rate in Sacramento California. The California state sales tax rate is currently 6. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

TaxSecured saccountygov FAQ. Those district tax rates range from 010 to 100. 2021-22 Sacramento County Property Assessment Roll Tops 199 Billion.

Postal Service postmark Contact Information. The Sacramento sales tax rate is. Sellers are required to report and pay the applicable district taxes for their taxable.

The December 2020 total local sales tax rate was. The tax is imposed on all transfers by deeds. Identify the full sale price of the property.

View the E-Prop-Tax page for more information. The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. This is the total of state county and city sales tax rates.

Property information and maps are available for review using the Parcel Viewer Application. In Sacramento County only the City of Sacramento has established a City Transfer Tax Sacramento City Code section 316020 and does not receive any DTT revenue. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of.

The minimum combined 2022 sales tax rate for Sacramento County California is 775. 110 x 500 550. The 2018 United States Supreme Court decision in South.

The Sacramento County sales tax rate is 025. Learn all about Sacramento County real estate tax. You can print a 875 sales tax table here.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. 500000 1000 500. The County sales tax rate is.

Combined state and local tax rates in the city of Sacramento are 875 and 775 in Roseville Sacramento County and Folsom. California has a 6 sales tax and Sacramento County collects an additional 025 so the minimum sales tax rate in Sacramento County is 625 not including any city or special district taxes. Sacramento CA Sales Tax Rate.

Each TRA is assigned a six-digit numeric identifier referred to as a TRA number. The current total local sales tax rate in Sacramento CA is 8750. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax.

Tax Collection and Licensing. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025. The sales tax jurisdiction name is Sacramento Tmd Zone 1 which may refer to a local government division.

Carlos Valencia Assistant Tax Collector. Tax Rate Areas Sacramento County 2022. 700 H St 1710 Sacramento CA 95814 916 874-6622.

2020 rates included for use while preparing your income tax deduction. Did South Dakota v.

8790 State Highway 70 Marysville Ca 95901 Mls 19000365 Zillow Marysville Real Estate Virtual Tour

Women Make 3 Key Investing Mistakes Investing Start Investing Bond Funds

This Girl Plays Rough Shirt In 2022 Mens Tshirts Girls Play Print Clothes

California S Highest In The Nation Gas And Diesel Taxes California Globe

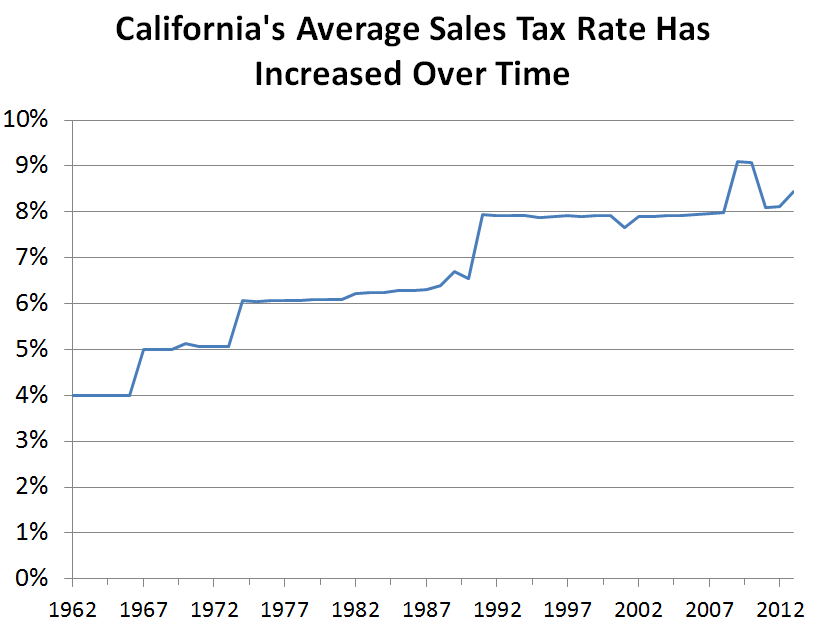

California S Sales Tax Rate Has Grown Over Time Econtax Blog

Property Taxes California Must Keep Proposition 13 Mortgage Rates First Time Home Buyers Mortgage

Levelling Home Sales Luxury Estate Level Homes Estates

Mean Elevation Of Each State In The U S Oc 2300x1500 Illustrated Map Map Usa Map

California City County Sales Use Tax Rates

Homes Are Selling 8 Days Faster This Spring Says Realtor Com Real Estate News Marketing Housing Market

Housing In Infrastructure Bill Real Estate Agent And Sales In Pa Anthony Didonato Broomall Media Delaware Coun Infrastructure Sale House Real Estate News

Why Do Stock Prices Fluctuate Trade Brains Stock Trading Strategies Stock Market Stock Market Investing

Sales Tax Rates Finance Business

California Sales Tax Rates Vary By City And County Econtax Blog

Real Estate Market Update 5 Reasons Why You Should Buy A House Home Buying Real Estate Infographic Real Estate

New Jersey New Homes For Sale Https Www Pinterest Com Njestates1 Nj New Homes For Sale Thanks To Http Www N New Homes Luxury Real Estate Real Estate Nj